LOOKING FOR FOSTER FAMILIES IN ARKANSAS

Second Chance Cocker Rescue is excited to share that one of our board members, who is also an adopter and dedicated volunteer, has recently moved to Northwest Arkansas! With her now living in the area, we’re hoping to grow our local foster network to help more Cockers in need.

Our headquarters are located in Jamestown, California but as we continue to receive requests for help from families in Northwest Arkansas, we would love to have foster homes closer to where she lives so we can better serve the community.

We know we have amazing supporters and fans from all around the world. If any of you happen to live in Arkansas or the surrounding area, Debra would especially love to connect with you!

If you’re interested in becoming a foster family or know someone who might be, please reach out! You can call or text Debra at (661) 303-9867 for more information.

Please look over this website for more information about the work we do.

Thank you for helping us give these sweet dogs the second chances they deserve!

“That’s not a cocker!”

Cockers will always have top billing in our hearts. But every so often, we get a call about a small dog with challenges we can help with, and if we have the space, we’re going to say yes.

Zsa Zsa is a little Maltipoo who came to us from another rescue after she bit their foster mom. They didn’t have the resources to support her, but we did. And when you can help… how do you say no?

Cockers will always be our top priority.

But when you open your heart, it just gets bigger, and makes room for more.

Your support allows us to make truly miraculous differences in each dog’s life.

Donate: https://tinyurl.com/ek8n44cf

Venmo: secondchancecockerrescueorg@sccr123

Check:

SCCR, PO Box 1419, Twain Harte, CA 95383

2025: 62 COCKER SPANIEL CELEBRATIONS!

In 2025, Second Chance Cocker Rescue helped 62 dogs find their perfect families. Every wagging tail in this video represents a new beginning. Thank you to our amazing donors, adopters, fosters, vets, transporters and volunteers for making this possible! Here’s a little montage of the happy tails of 2025!

Music credits:

“Be Happy” BoDleasons

“Home” Phillip Phillips

We’ve really found our rhythm here at the Sanctuary in Jamestown, California.

Thanks to an incredible team, this place runs with heart, structure, and a whole lot of love. Howard, our on-site kennel manager, keeps everything running smoothly day to day, while Samantha oversees our clinic and serves as Head of HR for all staff. Together, they help ensure our dogs and our people are supported and set up for success.

Our kennel staff and volunteers do so much more than feed and clean. They walk the dogs, play ball, sit and cuddle, and make sure every dog feels safe, happy, and ready for their forever home. With huge yards and carefully matched play groups, our dogs have plenty of room to run, play, and just be dogs.

Each bungalow is heated in the winter, air-conditioned in the summer, filled with comfy beds, and includes a porch where the dogs can relax and watch the world go by. Nestled among the trees, the bungalows get wonderful natural shade during the warmer months.

Howard and his wife live on site to watch over the dogs, and the entire property is double-fenced for maximum safety and peace of mind.

Our clinic team is truly something special. Dr. Temple is amazing, and her staff could not be better. We’re so grateful for them. Because of this team, we’re able to offer low-cost spay/neuter services, vaccinations, and very soon… dentals!

We’re incredibly proud that we can take in dogs many other rescues can’t. With skilled staff and professional trainers, we work patiently with these dogs, carefully evaluate them, and place them in just the right homes. We’ve seen real miracles happen here. ![]()

While we’re licensed for 30 dogs, we intentionally keep our numbers closer to 25 so we always have room when emergencies arise. We’ve even been able to help local rescues by housing small dogs when they needed support, because this work only succeeds when we work together.

We love this place, and we love sharing it. Please call Elizabeth anytime at 805-687-4674 to schedule a tour – we’re always happy to show off the Sanctuary and what we’ve built together.

Want to support the Sanctuary?

Every donation, large or small, helps us provide daily care, medical treatment, training, and safe housing for dogs who truly need it. Your generosity allows us to continue this work and say “yes,” giving dogs the second chances they deserve.

Click or copy and paste here to donate: https://tinyurl.com/ek8n44cf

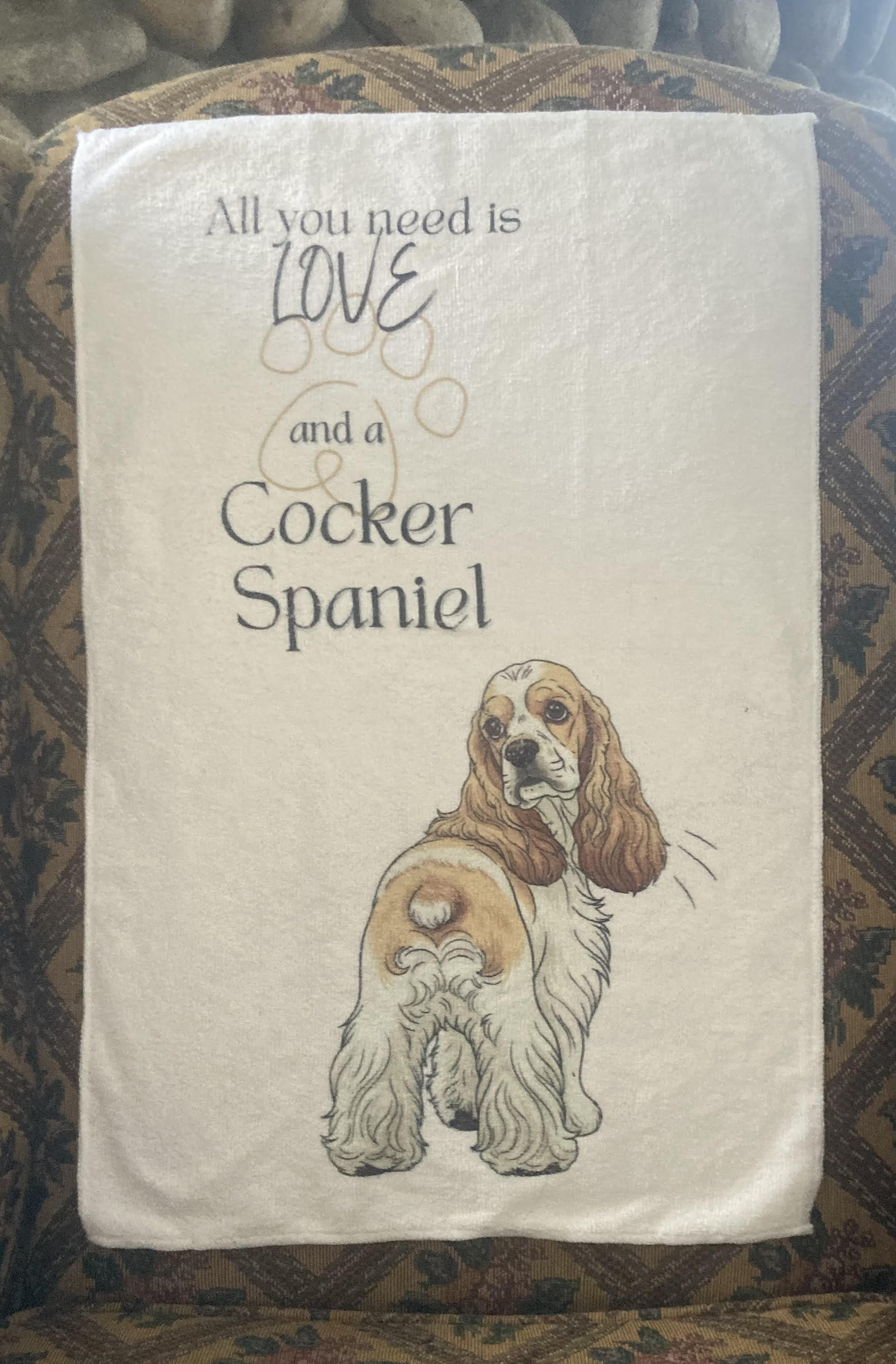

Cocker Tea Towels For The Holidays-SOLD OUT

Fill your kitchen with Cocker cuteness! These tea towels come in terrycloth or a cotton weave. They make great gifts for Cocker lovers. They are $25 for four towels. Shipping is included. Let us know what style you prefer.

SOLD OUT

2026 Calendars ON SALE-$20 each

$20 each–ON SALE!!!

Price includes shipping

Sweet Thoughts For Carrot Cake

Our Brave Boy Carrot Cake Needs a Little Extra Love Tonight

As we shared in our last post, this sweet soul has been carrying around a painful mass on his ear. Today, the vet confirmed it needs to come off, and soon. She’s hopeful she can remove it with clean margins and will send it out for biopsy to learn more.

A simple tissue sample wouldn’t give us any answers now, as the area is necrotic. Surgery is the safest, most effective option, and we’re not wasting any time. He’ll be staying overnight at the clinic and heading into surgery first thing in the morning.

The vet estimates he’s middle-aged, and we’re hopeful this will be the start of a much healthier, happier chapter for him. We said YES to the surgery! The estimate is $2,200, and we urgently need your help to cover his care. We can’t do it without you, and every donation brings us closer to giving him the pain-free life he deserves.

Ways to Donate:

PayPal: https://www.paypal.com/donate/…

Venmo: secondchancecockerrescueorg@sccr123

Check:

SCCR, PO Box 1419, Twain Harte, CA 95383

Please share too!

Questions? Please call/text Elizabeth @ 805-687-4674.

Thank you for standing by him and giving him a true second chance.

Open House

Date: Saturday June 21, 2025

Time: 10am-2pm

Location: 9785 Peppermint Creek Rd Jamestown

Enjoy lunch on us – Hot Dogs, Soda, and Homemade Cookies!

Come learn more about our mission

Meet the team

Tour clinic and meet the dogs

Boutique Auction– Bid on amazing items while supporting a great cause!

We can’t wait to see you there! Bring your friends and family for a fun and meaningful day. Follow the signs for parking in the back.

Sweet Special Boy

Meet Kalo, the sweetest little cuddle muffin! ![]() This 10-week-old baby was born blind and deaf, but that doesn’t slow him down one bit—he gets around like a pro! He loves curling up with his head on your foot for naps and playing with his foster dog siblings. Using his nose, he quickly learns his way around a new home. Since his foster home has stairs, he’s being trained to use a piddle pad.

This 10-week-old baby was born blind and deaf, but that doesn’t slow him down one bit—he gets around like a pro! He loves curling up with his head on your foot for naps and playing with his foster dog siblings. Using his nose, he quickly learns his way around a new home. Since his foster home has stairs, he’s being trained to use a piddle pad.

Kalo may be a special needs pup, but he’s full of love and absolutely worth the extra snuggles! Big news—Kalo found his forever home! His new dad drove all the way from Southern California to pick up this precious boy, and we couldn’t be happier. Now, Kalo is spending National Puppy Day in his new forever home, surrounded by love and some SCCR Cocker alumni to show him the ropes!

Pookie

We got an urgent call from the Hayward shelter about a six-year-old Cocker Spaniel in desperate need. Sweet Pookie had come in with a broken back leg, and our hearts broke for him. We didn’t hesitate, we said yes immediately and rushed to bring him to safety.

At the vet, we learned that Pookie’s injury had been left untreated for far too long. The damage was severe, and the only way to ease his pain now is to amputate the leg.

Through it all, Pookie has been nothing short of amazing. Despite the pain he’s endured, he’s incredibly sweet, friendly, and loving. He’s the kind of dog who melts your heart with just one look – and what a handsome boy he is!

We’ve scheduled Pookie’s surgery as soon as possible, and with your kindness, he’ll be on his way to recovery and ready to find his forever family. Your donation, no matter the size, will make a world of difference. It will help cover his surgery, care, and the fresh start he so desperately deserves.

Pookie’s spirit is unshaken, and with your support, we can show him what love really feels like. Let’s help this beautiful boy take his next steps into a brighter, happier future. ![]()

Please donate today to give Pookie the gift of healing and hope.

Thank you!

DONATE HERE:

https://www.paypal.com/donate/…

SEND A CHECK:

SCCR, PO Box 1419, Twain Harte, CA 95383

VENMO US:

secondchancecockerrescueorg@gmail.com